Interest-only home loans are under the spotlight again with two of the big four banks announcing further adjustments to interest-only lending yesterday, in addition to The Australian Prudential Regulation Authority (APRA) initiating additional supervisory measures in March 2017.

In an update to mortgage brokers this week, ANZ announced that from Monday 29 May, interest-only availability for both owner-occupier and investment lending will be restricted to maximum 80 per cent LVR for new and increased lending.

Similarly, Westpac announced that effective Monday 15 May, the maximum LVR (inclusive of any capped mortgage insurance premium) for owner-occupied interest-only loans will be 90 per cent. This applies to both new loans and further loans (loan increases and top ups).

Even if owner-occupied borrowers meet the requirements to qualify for interest-only repayments, they are being asked to justify why they should be given interest-only. This is where a mortgage broker is key to securing a loan structure that suits the borrower as they are able to mitigate any potential issues and can identify the most favourable reasons for an interest-only repayment structure.

Very kindly, (insert sarcastic tone here), ANZ will waive the renegotiation fee for customers seeking to switch from interest-only to principal and interest repayments.

Borrowers should budget for P&I repayments

Whilst existing loans aren’t affected by these changes, new borrowers should start budgeting for principal and interest (P&I) repayments rather than interest-only, particularly if they are looking at the major banks.

Generally speaking, P&I repayments are around 35-45% higher than an interest-only loan structure based on a 30 year term, so borrowers need to review their budget for both owner occupied and investment property. Investors might find their once positively geared property is now neutral or negatively geared and a short fall may need to be covered.

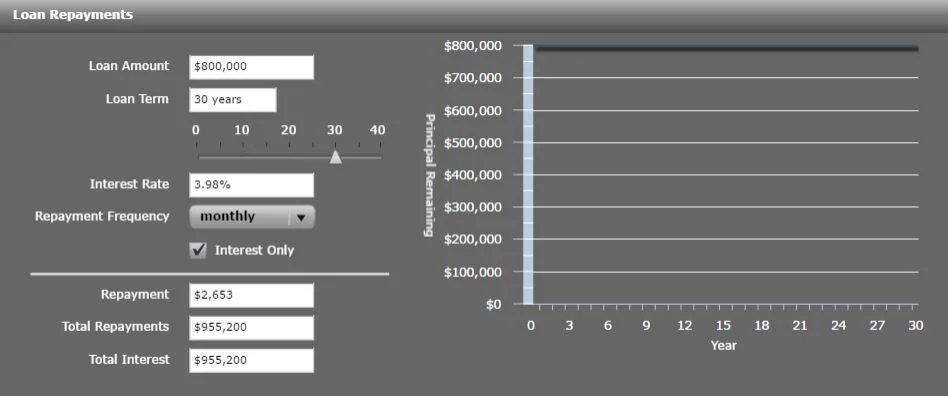

On an $800,000 loan over 30 years, the monthly repayments go from $2,653 on interest-only to $3,810 P&I whilst on a low interest rate of 3.98%. That’s a $1,157 difference per month. A family trying to find an additional $267 per week can have a massive impact on their way of life. Calculate your loan repayments here.

Stabilise your budget with a fixed interest rate

With recent changes and the threat of the big banks passing on the government’s ‘bank levy’, borrowers should consider fixing their interest rate or even a portion of their loan to stabilise their budget. Dependant on strategy, a fixed interest rate may suit families or long term investors who are concerned with the potential of fluctuating interest rates. Most lenders offer a split loan facility enabling borrowers to fix a portion of their loan whilst enjoying the benefits of variable such as an offset account.

What if I can’t afford P&I repayments?

We all know getting in to the property market is tough but the good news is interest rates are still very low, meaning now is actually a great time to review your budget and pay down the principal of your loan. Let’s face it, it would be much harder to do if interest rates were around the 6% or 7% mark, so take the opportunity while you can.

For those whose property strategy doesn’t align with P&I repayments such as investors and new home builders, there are still interest-only options. Whilst the major banks are clamping down on handing out the interest-only loans, they are still available. Second tier and non-major lenders are still offering interest-only home loans without the tough restrictions, so think outside the ‘big bank box’ and consider a smaller lender.

Second tier and non-major banks aren’t affected by the bank tax recently introduced by the government.