Tighter lending criteria and a change in how lenders are assessing loans is leading to a situation where one in ten property investors are struggling to get finance and countless others simply can’t borrow enough to invest, according to a report by JP Morgan.

The transition by several banks to base proposed loan repayments on a principal and interest repayment term, as opposed to interest only, already has some investors regrouping in order to come up with double or triple the income they required previously.

There have also been restrictions placed on non-resident investors, foreign income and even some Sydney suburbs being blacklisted by some lenders.

Serviceability

With many lenders now assessing serviceability on principal and interest repayments, investor’s income and rental return becomes incredibly important.

Interest only investment property loans are now a rarity, but Mint Equity does know of lenders who haven’t changed their servicing just yet. For those investors who still need to work with lenders only offering P&I repayments, the difference can rule out many. For example;

An interest only investment property loan of $1 million at an interest rate of 4.5% equals $45,000 per year in repayments.

Whilst a principal and interest investment loan of $1 million over a 30 year term, at an interest rate of 4.5% equals about $60,804 per year in repayments. Although the banks generally assess the proposed loan repayments at a rate of at least 7.25% which equates to $81,864 per annum taken into account for the banks serviceability assessment.

These serviceability calculations against actual repayments shows a gap of $36,864 per annum of available income for servicing the actual loan, which means the investor has a reduced borrowing capacity under the banks new credit criteria.

Based on the banks assessment rate of 7.25%, this results in having to generate approx. an additional $36,864 per million dollars per year. For a $3 million portfolio that’s an additional $110,592 of net income required to service the same portfolio.

Overseas investors lending restrictions

Westpac, St George, Bank of Melbourne and BankSA will no longer accept mortgage applications from non-residents. The banks will also no longer accept any foreign self-employed income applications or applications from temporary visa holders living overseas.

In addition, LVRs for acceptable domestic applications with foreign income will be reduced from 80 per cent to 70 per cent.

Whilst the restrictions on overseas investors could be seen as a boost for local investors, it was short lived since lenders proceeded to tighten their lending criteria.

“Mint Equity is supporting many investors with securing finance for their next investment property. In fact, now is a great time for opportunistic investors to buy as competition is drying up.”

Blacklisted suburbs for lending

Add to mix the fact that some lenders are actually blacklisting or reducing the lending ratios in some suburbs, there’s no wonder that some investors aren’t able to secure finance.

Some Sydney property hotspots have been flagged as high risk for lending. Predominantly because of the high prices that some lenders feel are above true value. In particular, apartments in these suburbs have drawn the attention of lenders due to a perception of oversupply.

In March this year, AMP Bank blacklisted over 140 suburbs, ANZ and NAB over 40 postcodes across Sydney and Melbourne to apply more stringent lending criteria.

The supposedly confidential blacklist is described as a list on which lenders have identified certain high-density areas and have put provisions in place in order to manage risk and over-supply. Overall, they herald it as a prudent approach to managing risk. Several big lenders are reportedly circulating blacklists of suburbs where apartment buyers (owner-occupied and particularly investors) will now face tougher terms and conditions including a higher scrutiny of their ability to service any loan.

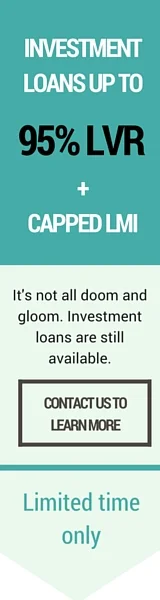

It's not all doom and gloom

All in all, these recent changes to slow the property market, particularly in Sydney are impacting local and overseas investors. But that doesn’t mean you can’t buy an investment property. Mint Equity is supporting many investors with securing finance for their next investment property. In fact, now is a great time for opportunistic investors to buy as competition is drying up.

Photo courtesy of World Architectural Festival 2015

We now have a lender that is showing confidence in the investor market by returning to borrowing caps of 95% plus capitalising the Lenders Mortgage Insurance (LMI) onto the loan, effectively providing an end ratio (LVR) of up to 97%.

Exploring cheaper suburbs is a great way to get or stay in the investor market. Four out of the five cheapest suburbs in NSW are now found on the Central Coast so it pays to do your research now while the investor market is quiet.

Now, more than ever, a mortgage broker is the key to securing investment financing. A professional mortgage broker is up to date on the tighter lending criteria for investors and the ever changing policies.