Have you considered using one of the new ‘compare the market’ interest rates websites? A word of caution if you have; all that shines is not gold. And often the shiny cheap interest rates aren’t as low as you may think.

They bring to mind that great quote ‘If you think it’s expensive to hire a professional, wait until you hire an amateur’. It might seem like a cheap and easy option at first, but savvy mortgage holders need to delve a little deeper and look at the true costs beyond the interest rate.

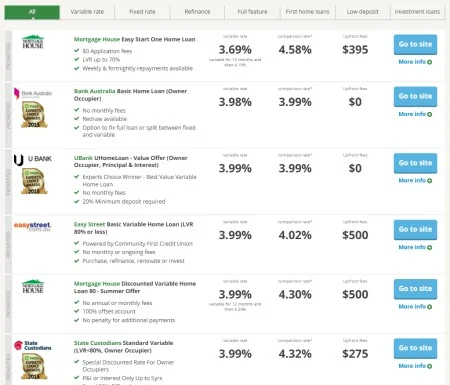

The ‘cheapest’ home loan rates are very rarely available through these types of sites and the ‘cheapest’ is not usually the best choice for borrowers anyway. They are often packed full of restrictive policy requirements and hidden fees. It usually ends up costing you more, in money and lifestyle restrictions, than a mortgage with a slightly higher interest rate.

The CLick and flick model

Compare loan sites are usually a seemingly straightforward, click and flick model. This model still leaves you with all the leg work to do; you will still need to actually contact each lender and find out if you qualify for that loan, or not. On some sites you’ll have to provide your personal contact details to see the results, which often turns into endless emails or phone calls.

Click and flick model means you still need to do the leg work and contact each lender.

Essentially these sites provide the industry information but without the expertise to decipher the nuances of the policy you’re signing up to. A better solution to comparing interest rates is to find a good mortgage broker who is accredited with the major and 2nd tier lenders that will provide you with options and expertise. While some mortgage brokers charge a fee for service, Mint Equity provides a personalised service at no cost as we are remunerated by the lender you choose. We do the digging for you so you don’t need to spend your valuable time trying to work out if you will actually qualify for the mortgage you want.

There's more to a mortgage than just interest rates

There’s so much more to a mortgage than just the interest rate and here’s where these types of sites come unstuck – that’s all they focus on; they only compare interest rates. They don’t compare or even take into account all those other aspects of a mortgage that will impact on your lifestyle, potentially for the next 30 years. For example, trying to find a home loan that has the right flexibility for your specific personal requirements can become difficult and confusing.

And don’t think you can use a compare the mortgage rates type of service to find an ‘outside the box’ type home loan. Construction loans, family guarantees, self-employed or non-permanent resident cases are just not catered for.

Features to consider

When you source a mortgage or are looking to refinance there are many aspects to consider; the interest rate is just one, but these compare mortgage interest rates websites will try and have you believe that interest rates are the most important (sometimes only) consideration.

They certainly don’t think about other features such as:

- Discharge fees

- Refinancing fees

- High establishment fees

- Loan servicing fees

- Honeymoon offers (where the interest rate can shoot up after an initial period of time)

- Offset or redraw facilities

- Type of rates (fixed, variable or both)

- Repayment holiday options

The cheapest is not always the best but that’s the seemingly only focus of these compare the market websites.

Take advantage of free expert advice

Engaging a mortgage broker, such as Mint Equity, ensures that you have a real person (not a website algorithm) in your corner to find the right home loan for you regardless of whether it’s a for a first home, a refinance, or an outside the box mortgage. Because that’s what we do – think outside the box to get the very best home loan for our clients and we understand that’s about more than just the current interest rates on offer. As an example, we recently saved a client over $13,000 in interest per annum and in excess of $7,000 in fees.

The client initially requested a low-doc application as he thought his financials wouldn’t be sufficient to service the loan, however using our expertise we dug a little deeper and reviewed the full financial position with a number of entities and were able to structure the application on full documentation.

Using a mortgage broker allows you to build a relationship and have a real person you can go to for advice and assistance, even with a live-chat function you can’t get that from a website.