Here’s the thing about mortgage interest rates, the pricing depends on two things; the RBA official cash rate, and the cost of funds to banks (where the banks source their wholesale funds from). Simple, right?

Not really. The elements that effect the RBA official cash rate and the wholesale fund prices are way too complex to go into in this little article, but the reality is, USA elections, ‘Trump-economics’, China, Bonds, Derivatives, trade and export, GDP, inflation, employment and consumer sentiment (to name a few) all have an impact on how much our home loans cost us.

2016 saw the lowest recorded RBA official cash rate, and we think it can go even lower in 2017.

But before we go on, predictions and ideas mentioned in this article are the opinion of Mint Equity and are based on market knowledge and insights. You should always speak with your Financial Planner, Mortgage Broker and/or Accountant before you make any financial decision. Lecture over, here are our predictions for 2017;

- Official cash rate expected to decrease in early 2017

- Variable interest rates to increase mid to late 2017

- 2017 is the year for fixed interest rates

- Access to finance will continue to tighten

Official cash rate expected to decrease in early 2017

7 February 2017 is when the RBA Board meets again to decide on the cash rate. The team at Mint Equity believe that we will see a decrease in the official cash rate in the February or March announcement. However, we don’t think lenders will pass on the rate reduction to consumers.

Variable interest rates to increase mid to late 2017

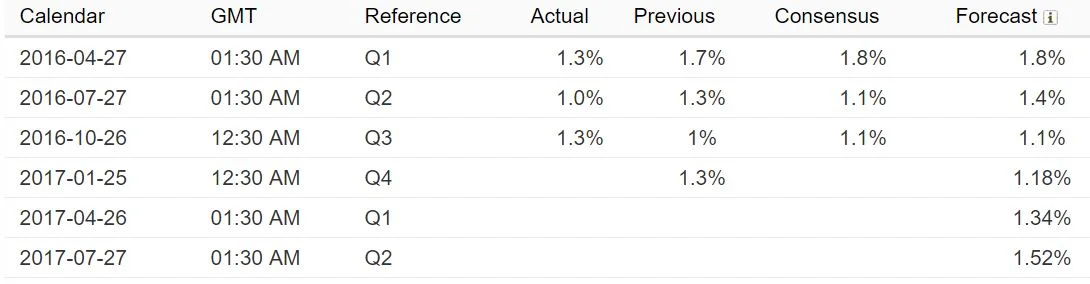

With inflation hitting a record low in 2016 and a forecast decrease in January 2017 to 1.18% (from 1.3% in October 2016) the RBA is unlikely to increase the official cash reserve. Forecasts for April and July 2017 are set to increase to 1.34% and 1.52% respectively, so it’s more likely we will see an increase in variable interest rates from May 2017 onwards.

The variable interest rate market is generally reflected in the RBA cash rate plus a lending margin. For example a bank or lender will generally add around 3% to 4% margin to the RBA cash rate to remain competitive in the variable interest rate market. Looking historically, in November 2010 the RBA official cash rate was 4.75% and Commonwealth Bank’s (CBA) Standard Variable Home Loan was 7.81%, giving CBA a margin of 3.06%.

Today, CBA’s Standard Variable Home Loan Interest Rate is 5.22% and the RBA cash rate is currently 1.5%, equating to a margin of 3.72%.

There will be pressure from the government for the banks to pass on the rate cuts should they happen in February but we believe the banks will be protecting their profit margins against an unstable market. We also believe the banks will increase their variable home loan interest rates as soon as the official cash rate increased.

Australian Inflation Rate

2017 is the year for fixed interest rates

In December 2016, we saw fixed interest rates increase with some lenders. Some banks are no longer willing to offer long term fixed interest rates at lower costs. Fixed interest rate increases can be direct result of a higher cost of funds or the expectation that the cost of funds will increase in the near future.

Cost of wholesale funds have been increasing since January 2016, (see Wholesale funding costs rise for big banks) and there are many aspects that affect the price of wholesale funds, however it is the consumer’s back pocket that takes the hit.

We believe that the early increases to fixed interest rates in December 2016 is a sign of things to come. Banks are preparing to charge higher fixed interest rates to preserve their profit margins.

We think the value with fixed interest rates are in the shorter term period of 2-3 years rather than locking funds away for 5+ years. This also gives borrowers more flexibility to change strategy during the fixed period because the term is shorter.

When is the right time to fix your interest rate

Timing is everything in finance and property, so securing a fixed interest rate early in 2017 may save home owners and investors in the long term. However, variable or a fixed interest rate needs to fit with your strategy. There is no point locking in a fixed interest rate for 5 years when you think you’ll be selling within 2 years. The financial costs of breaking the home loan will outweigh the money you would save by fixing the home loan.

For those borrowers where a fixed interest rate aligns with their strategy, the first quarter of 2017 is a good time to secure sub 4% fixed interest rates. Director of Mint Equity Zac Peteh said “2017 is going to be an interesting year for borrowers. I think rates are going to increase as the year goes on and lenders will continue to modify their credit policies to restrict and encourage certain borrowers. Now is a great time to review your borrowing capacity and secure good fixed interest rates before they increase.”

Access to finance will continue to tighten

We continue to see changes to lending criteria, credit policies and borrowing capacity calculations across many lenders. Essentially these financial terms translate to ‘why you can borrow’, ‘who can borrow’ and ‘if you can afford to borrow’. For example; a couple working full time in stable employment with no dependents have a greater chance of approval if they are looking to borrow to buy a home to live in. They would be considered a lower risk applicant that say someone who was self-employed with 2 dependents looking to purchase an investment property.

We’ve seen over the last 12 months’ borrowers reclassified from low to high risk categories by lenders because of their employment type, purchase/finance reason and living expenses based on how many dependents (children) they have.

Whilst lenders have set policies that change on a regular basis, the way the lenders interpret their own policy varies between credit reviews. This is where a mortgage broker is invaluable. Sydney mortgage broker, Mint Equity, guides home owners and property investors through the myriad of policies from over 40 lenders and 100’s of lenders.

With that all said, our predictions and ideas mentioned in this article are the opinion of Mint Equity and are based on market knowledge and insights. You should always speak with your Financial Planner, Mortgage Broker and/or Accountant before you make any financial decision.

This article was also published on News.com.au

Footnotes

Australian Inflation Rates

Wholesale funding costs rise for big banks