It's no secret - Sydney is one expensive city, especially if you are looking to buy a home. Sydney's property price surge has been getting more prominent for quite some time. In fact, it's the longest property price upswing in the city's history.

What makes buying a home in Sydney so unaffordable for most people is that incomes have not risen at anywhere near the same rate as house prices. There's talk of the imminent burst of the property bubble in Sydney, yet continued interest in buying a Sydney home from international investors with deep pockets may see prices stay high.

While the future of property prices in Sydney remains to be seen, people will likely never go back to the way they used to purchase homes. The way properties are bought has well and truly changed, perhaps for good. The much-maligned upward swing of Sydney property prices over the years has paved the way for a new pattern of home owning.

Wages and cost of living making deposits harder

It's becoming harder and harder to scrape together the 10-20% required for a house deposit. Data shows that as property prices have risen, the household income growth has stalled. The proportion of household income in Sydney required for a 20% deposit has increased from 116.8% in 2011, to a whopping 167.7% in 2016.

Interestingly, trying to save for a deposit for a property in Regional NSW is virtually at the same level in 2016 than it was in 2011.

Sydney home loans more manageable now than in 2008

While the proportion of household income to save the 20% deposit is at its highest level, it's not all bad news. It is now easier to service a home loan Sydney than it was in 2008. The national proportion of household income required to service an 80% LVR mortgage has gone down dramatically in the last nine years, making home loans much more manageable.

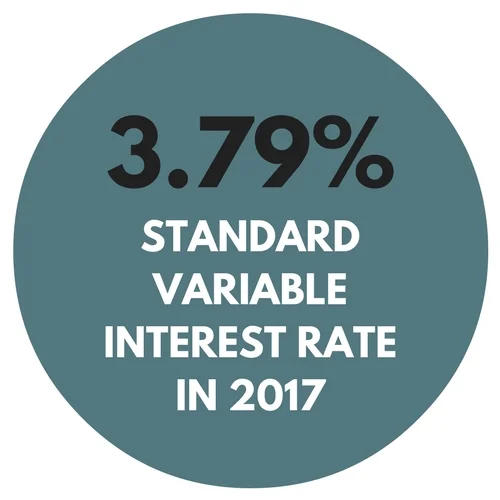

This is mainly due to the RBA cash rate sitting at 7.25% in March 2008 with standard variable interest rates around 9.35%! Eight years later, the official cash rate sits at 1.5% and borrowers have been able to secure home loan interest rates as low as 3.79%.

There is one big difference though, the amount of money home buyers were borrowing a lot less.

Investment property first, then buy a home

How do people afford to buy houses where they want to live these days? Many are getting around sky-high home prices by becoming a landlord before they become a home-owner. Say goodbye to the Australian dream of buying your perfect home the first time around. Instead of buying where they live, many property buyers instead look to buy in more affordable locations. This gives them some wiggle room to rent and pay off the property while continuing to live in their chosen area with the out-of-reach prices.

The popularity of becoming a landlord before becoming a home owner makes sense, as it is a smart way to get into the property market. If you can get a home loan to add to your deposit savings, those renting your property can help you pay it off.

First home buyers should avoid Sydney

Here’s an idea for first-home buyers – stop trying to buy in Sydney. Property prices in inner Sydney suburbs and many outer ones too are simply so far out of reach for first-time buyers. It's much more affordable and will be much less stressful to invest in an area of regional New South Wales or even inter-state cities on the rise such as Adelaide.

First Home Buyers should avoid Sydney

Sydney home loans are even more difficult to secure than they were 2 years ago. Banks have implemented post code restrictions on certain Sydney suburbs where there is an oversupply of properties. It stands to reason the lower the purchase price, the smaller the deposit required, which is why first home buyers should look outside of Sydney where property prices are still attainable.

The median house prices and price to income ratios are so much more comfortable in regional NSW compared to in Sydney. In 2016, the average Sydney home buyer was forking out 8.4 times their annual income to buy a home. Rates in regional NSW are much less scary, averaging at just 6.6 in comparison. Yet the proportion of household income required to rent a home in both Sydney and regional NSW was fairly comparable, at 28.9% and 29.9% respectively.

How to get a Sydney home loan?

If you do decide that Sydney is the place to buy, speaking with mortgage broker Mint Equity will help you through the home loan application process. Experience and knowledge of each lender’s credit policies and appetite to lend is key to securing your home loan.

Information and graphics have been sourced from the Core Logic Housing Affordability December 2016 Report

Interest rate data sourced from Australianpolitics.com